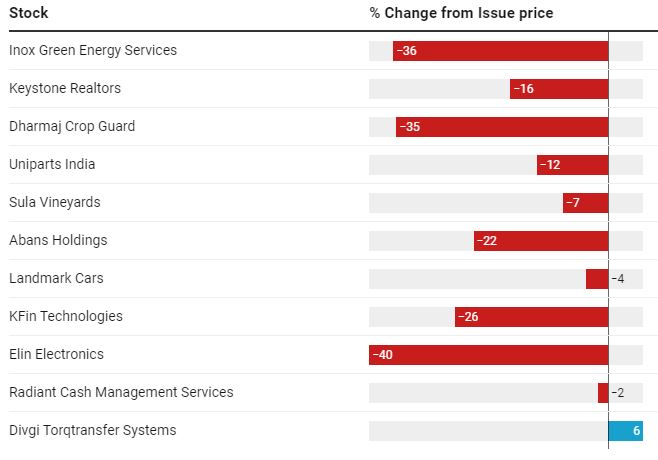

According to an analysis conducted by the Economic Times, the pomp and grandeur that surrounded some of the recent initial public offerings (IPOs) has fizzled out in just a few short months, with 10 out of 11 recent debutants selling at a discount over their issue price.

With the exception of Divgi TorqTransfer, ten other companies, including Inox Green Energy, Keystone Realtors, Dharmaj Crop Guard, Uniparts India, Sula Vineyards, Abans Holdings, Landmark Cars, KFin Technologies, Elin Electronics, and Radiant Cash Management Services, are currently trading at a discount of up to forty percent from their initial public offering (IPO) price.

It is interesting to note that the shares of six of these eleven businesses have started trading at a premium, while the listings on the bourses for four others have resulted in a discount, and one company’s entry was relatively neutral.

The initial public offering (IPO) price of Elin Electronics was 247 rupees, and the company is presently trading at a 39 percent discount from that price. On the BSE, the company’s shares were priced at Rs. 243, reflecting a slight markdown of slightly more than one percent.

In the meantime, shares of Inox Green Energy Services and Dharmaj Crop Guard are also selling at a discount of more than 35 percent in comparison to their initial public offering prices of 65 and 237 rupees, respectively.

Inox Green Energy Services’ initial public offering (IPO) was oversubscribed 1.55 times, and the company’s shares were published at a price that was 7% lower than the issue price. On the other hand, Dharmaj Crop Guard had an impressive start on the exchange, as its shares were listed at a 12% premium over their intrinsic value.

When compared to their initial public offering values, the share prices of Keystone Realtors, Uniparts India, Sula Vineyards, Abans Holdings, Landmark Cars, KFin Technologies, and Radiant Cash Management Services were all trading at a discount of between one and twenty-five percent.

[IPO Pomp Fizzles Out]

The lackluster performance of recently listed equities was attributed by industry professionals to expensive valuations as well as unfavorable market sentiments.

According to Avinash Gorakshakar, Head of Research at Profitmarch Securities, “the majority of the initial public offerings (IPOs) that have entered the market in recent times are priced to perfection, leaving hardly anything for retail investors.”

According to Gorakshakar, the fact that these stocks are currently selling at a discount does not indicate that they are poor investments. “A number of these businesses operate on solid financial foundations. Even if the company is doing well and the valuation is high, the stock won’t change right away, according to what he said.

The feelings of investors also play a significant part in public offerings, and it is eventually their level of optimism that will determine whether or not the issues get off to a good start. According to market analysts, when market sentiment is negative, fundamentals tend to take a back seat to sentiment.

If these companies can deliver the numbers on the earnings front for two to three quarters, the tide could turn relatively readily in the longer term.

In the most recent two to three months, the Indian equity markets have been extremely volatile. This can be attributed to a number of factors, such as the high interest rates, the Adani crisis, and the most recent banking crisis in the industrialized world. On a year-to-date basis, the benchmarks Sensex and Nifty have both experienced a loss of 6%.

What kind of actions should companies take?

If retail investors expect for listing gains in the current market, they might be in for a rude awakening, according to market analysts. “Allow some time for the dust to disperse. There is a lot of excitement surrounding the initial public offering (IPO) of any business. “Whether one wants to buy the stock at higher prices or wait for discounts, it all boils down to the risk-reward ratio,” Gorakshakar said.”